March 12, 2004

Pay No Attention....

Brad DeLong attacks Jerry Bowyer of the National Review for running fast-and-loose with the truth over the employment figures. Bowyer trumpets the fall in the unemployment rate from 6.3% in June 2003 (when Bush enacted his latest round of tax cuts) to 5.6% in Feb 2004. But Prof. DeLong has a problem with the argument:

Since June 2003, the household survey estimate of the number of working age Americans has grown by 1.53 million.* During that same period, the household survey estimate of employment has grown by 700 thousand. In order for the employment-to-population ratio to remain constant, a 1.53 million increase in the working-age population needs to be accompanied by an 950,000 increase in employment. According to the household survey, we are 250,000 short since last June at what we need to maintain the ratio of employed Americans to the working age population. For those extra 250,000 (according to the household survey), the past nine months' labor market news has not been good.

Now, I'm loathe to defend the National Review and hesistant to go after Professor DeLong on his turf (economics), but I'm going to disregard my better judgment this time, because I just don't know why (other than politics) DeLong is so negative about the economy.

If you look at the February BLS report on employment you'll see what I mean. The Table A reports use the Household Survey data that he's talking about. The official numbers on the BLS site are slightly different than Professor DeLong's and I can only assume he's applying some sort of correction to try to account for the fact that the BLS adjusted their population estimates downward (and thus the household survey numbers) in January 2004 based on new census estimates.

A quick look at June 2003 shows a Population Level, Civilian noninstitutional population, 16 years and over of 221,014,000. Feb 2004 shows the same figure at 222,357,000 which my calculator tells me is only an increase of 1,343,000 people (not the 1.53 million he claims). Looking at the same months, I see the Seasonally Adjusted Employment Level go from 137,673,000 to 138,301,000 giving us an increase of 628,000 jobs (not the 700,000 he shows). Again, his numbers may have a fudge factor to back out the Jan nudge.

But, using his argument, to keep the employment-to-population ratio the same, you'd have to add (1,343,000 * 0.623) = 836,689 jobs. So there is a shortfall of about 209,000 jobs. This corresponds to a fall in the employment-to-population ratio of 62.3 to 62.2%. Now here's the part I have a problem with. Prof. DeLong tries to use this fall in employment-to-population ratio to say that all is doom and gloom and the National Review's optimism is misplaced:

So what has happened? What has happened is that, for a number of different reasons, a lot of people have given up looking for work. The fall in the unemployment rate is not because the number of jobs has grown to encompass a larger share of the adult population, but because the fraction of the adult population who are looking for work has fallen as people have dropped out of the labor force.

But it's worth looking at these figures historically before we draw any conclusions from them. First, the employment-to-population ratio that he's talking about:

Next, the unemployment rate:

And finally the 12 month percentage change in the Consumer Price Index (the first inflation proxy I could find):

Does anyone notice anything about these graphs? How about the fact that, except for the late 1990's, we are at a historically high employment-to-population ration, a historically low unemployment rate, and a historically low inflation rate. And, all of the labor statistics compare quite well to Europe right now.

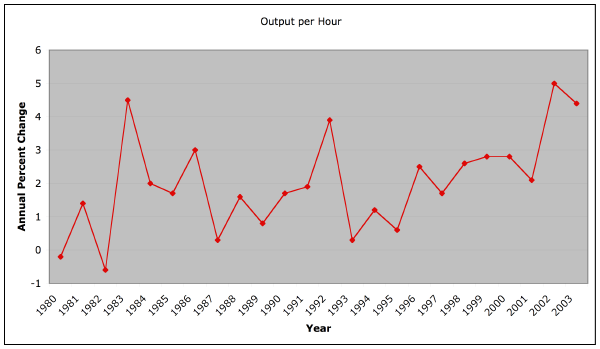

So why, oh why (to borrow a phrase from DeLong) would we want to compare ourselves to the dot.com bubble, about which there has been no end to the handwringing? That was unsustainable, that was why there was a crash. It makes complete sense that many people who wouldn't otherwise work decided to get a job in the biggest boom economy in 50 years. Comparing the present economic climate unfavorably to that one is foolish, and at best will simply encourage policies that lead to more bubbles. Here's another chart for you, of productivity growth:

Again, historically high levels. That's pretty damn hard to do. High labor participation rates, low unemployment, low inflation, high productivity growth. Not to mention during a war, just 2 years after the World Financial Center was turned to dust.

Now, everything is not perfect of course, and I think we probably do need to extend unemployment benefits because there's a great deal of transition going on in our economy now. But there is room for a little optimism, even from the National Review. The last thing we need is for a drastic change of policy because we're wishing for the good ol' unsustainable days of the bubble.

To put this in perspective from the other direction, just think, if we had the EU's average 8% unemployment rate, we would have another 3.3 million people unemployed.

So for the moment, we should be optimistic. Barring external forces, we seem to be in a pretty darn good recovery, and I think Alan Greenspan is right, even more jobs will follow soon. (2.6 million by year end? Nope. But a bunch.)

But external forces are what we should worry about. I argued below that the trade deficit will be handled by the floating exchange rate (that's what it's there for) but that oil prices were a big part of the rise. It's possible that continued high oil prices will put a break on the recovery – we should be concerned about that. It's obvious that Saudi Arabia is trying to influence our foreign policy by controlling the supply of oil, so we'll have to live with the higher prices until a) we back down from some of our democratic initiatives in the ME, b) we elect a new president that makes nice-nice with the Saudis, or c) the Saudis realize we won't give and decide they need the money to badly to keep prices high. Regardless of politics, I think c) is best for our national interest over all.

Update: I have an additional post with more graphs here.

Posted by richard at March 12, 2004 08:08 PMRich, once again I agree with you on the issue, but not your handling of it. The economy seems to be doing better. Fine. Is it because Bush is so wonderful? Who knows. The economy goes up and down and as far as I can tell it has little to do with which party is in the white house.

All our friend DeLong pointed out, however, was that the National Review was using the wrong statistic - which they are. Unemployment can be inaccurate and misleading since it only refers to those in the work force who have work or are looking for work. If people are indeed dropping out of the work force, unemployment figures will not tell you that. The National Review show 6.3% to 5.6% in unemployment figures, implying an improvement in the % of people out of work. DeLong rightly shows that this is indeed NOT the case and that the % of people out of work has increased. That's all he said - and he's right to point it out.

Now, would John Kerry's policies would improve things faster? Probably not. The point isn't that Bush's policy stinks, it's that the National Review is painting a misleading picture of the state of employment.

Thank you Professor DeLong for pointing out their damagogery.

Posted by: Mike F. at March 14, 2004 06:06 PMMike, true, they are both only telling half the story. But DeLong's post, with his tone and in the context of his other posts, was trying to pull one of those "Aha!" moments we've talked about before. (Except last time it was you complaining about Marginal Revolution doing it from the right.)

The National Review is correct. The unemployment rate has dropped extremely quickly. It is good news for person 5.61 to 6.3% (and even DeLong admits that this is 700,000 people). They are saying something factually true and trying to paint a positive picture on Bush's policies.

DeLong is also correct. They are more unemployed people now than their were in June 2003. The employment-to-population ratio has gone down from 62.3 to 62.2%. He is saying something that is factually true and trying to paint a negative picture (or at least tear down Bowyer's positive one).

But there's just as much selective use in his statements as the National Review's. He's implying that for 250,000 people "the past nine months' labor market news has not been good", presumably because they've been looking for a job and haven't been able to find one. But that's going too far with the numbers. In the same survey, people whose reason for not being in the labor force is "discouragement over job prospects" has stayed relatively flat in the last nine months – it certainly hasn't gone up by those 250,000 people. We've come off of a stretch of the highest labor participation rates in history, right in the middle of a huge boom. I would expect (and anecdotally have seen) some shift from two-earner households back to one-earners – simply because the financial incentives are not as great. People are also choosing now as an opportune time to go back to school, have kids, or start businesses.

Now, given those two (true) halves of the picture, I happen to believe that the positive picture is closer to the truth when you look at it historically, and that's what I tried to do in the post.

As far as your other point, whether the President matters, I don't know. He has the bully pulpit, but Congress enacts the laws.

Certainly, though, the policies do matter. Raising taxes or putting in place tariffs will likely slam the brakes on the recovery. Not doing enough to ease the transition of workers, though, could lead to demand side problems, loss of consumer confidence, and increased rigidity in a workforce that needs to stay flexible. So getting this right is important.

Finally, I think we have to wait until after April 15 (probably into June even) to see the true effects of Bush's tax cuts. I'm willing to hold off judgment overall until then, but for the time being I'm optimistic.

Posted by: richard at March 15, 2004 02:48 AM